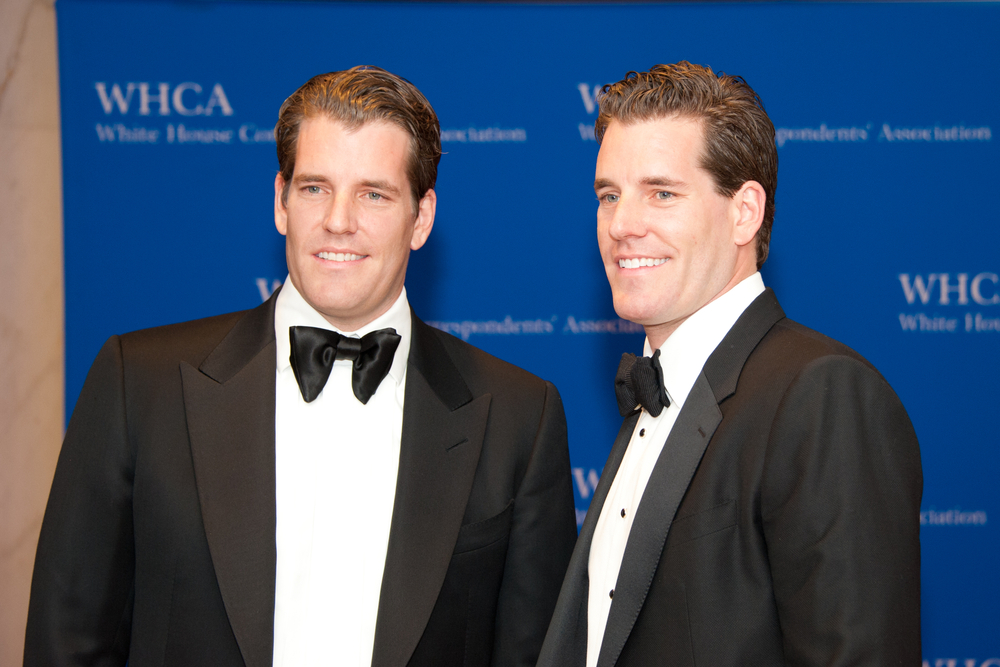

Cameron and Tyler Winklevoss’ quest to register The Winklevoss Bitcoin Trust as a Securities and Exchange Commission-recognized exchange-traded fund may have a real chance at success.

If approved, the first ETF assigned to a virtual asset will be awarded to a company selling stock in Bitcoin. While the stock market has a history of investing money in things that may not actually exist, an ETF for a virtual commodity breaks entirely new ground, even for a couple Harvard guys who sued Facebook.

And it might work. Today, Bloomberg broke down why the Winklevosses might win this one. But there’s at least one factor aligned against them and–cruel irony–there’s a Facebook connection here.

Here are three factors in the Winklevoss’ favor:

1. The Details

Some very specific changes were added to the risk section of Bitcoin’s (ETF) prospectus with the (SEC). One warns that key developers can stop maintaining basic Bitcoin operating procedures unless they are paid. A second change notes that Bitcoin will not be recognized by the Bolivian central bank; an odd risk to put into a preliminary contract but one that signals the prospectus is being looked at closely.

2. The Ticker

The Winklevoss Bitcoin Trust will be traded as Nasdaq: COIN in the New York Stock Exchange, we learned earlier this week. The amendment naming the potential ETF as Nasdaq: COIN was filed July 1, exactly one year after the Winklevoss’ filed the initial forms for turning Bitcoin into an exchange-traded fund. This puts COIN right on track for SEC approval.

3. Their Lawyer

The twins’ choice of Kathleen Moriarty, partner at Katten Muchin Rosenman in New York, also works in their favor. According to Bloomberg, Moriarty has helped everyone from Vanguard Exchange-Traded Funds (VIPERS) to WisdomTree bring new ETFs to the market.

She counsels broker-dealers on trading issues related to purchasing and selling ETFs in the U.S. and also works abroad, assisting the Stock Exchange of Hong Kong with the structure and development of the Hong Kong Tracker Fund and representing the American Stock Exchange and NYSE Arca in cross-listing the DIAMONDS Trust (DIA) on the Singapore market and in Europe. She was nominated for the 2014 IndexUniverse ETF Lifetime Achievement Award.

Not a bad rep to have in your corner.

Here’s why the Winklevii might fail.

Their nascent Bitcoin ETF could be beaten to the market . A separate company called SecondMarket–yes, the same SecondMarket that hit the tech trading scene in 2011 and practically cornered the market for trading private, venture-backed social media companies like Facebook (ahem) and Twitter–also operates a private Bitcoin trust for accredited investors.

According to ETF Trends, SecondMarket is looking to create an over-the-counter listing for Bitcoin and eventually register for a full ETF. With its experience in startup trading and working with the SEC SecondMarket would make for a ridiculously powerful competitor.

The Winklevii have a head start, however.

“Under the securities laws we are not permitted to discuss timing to launch or effectiveness,” Cameron Winklevoss told The Wall Street Journal. “However, identifying the ticker symbol and the exchange are two major events that further demonstrate that we are moving forward as expected.”